Understanding the New FinCEN BOIR Requirement for Business Owners

As a business owner, staying informed about regulatory changes is crucial. A significant update from the Financial Crimes Enforcement Network (FinCEN) now requires businesses to file a Beneficial Owner Information Report (BOIR). Let’s delve into what this means for you and your business.

What is the BOIR?

The BOIR is a new filing requirement introduced by FinCEN. It mandates businesses to report information about their beneficial owners. This rule aims to enhance transparency in business ownership and combat financial crimes.

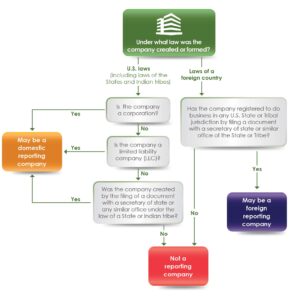

Who Needs to File?

Most businesses, including LLCs, corporations, and similar entities, are subject to this requirement. The rule explicitly targets entities created or registered to do business in the U.S.

Critical Information Required:

Filing a BOIR involves providing details about your business’s beneficial owner, including:

- Full legal name

- Any trade name or “doing business as” (DBA) name

-Report all the trade names or DABs. - Address (residential or business)

-Report the address of the principal place of business in the United States or, if the reporting company’s principal place of business is not in the United States, the primary location in the United States where the company conducts business. - State, Tribal, or foreign Jurisdiction of Formation

- Internal Revenue Service (IRS) Taxpayer Identification Number (TIN) (including an Employer Identification Number (EIN))

- If a foreign reporting company has not been issued a TIN, report a tax identification

number issued by a foreign jurisdiction and the name of such jurisdiction.

Each Beneficial Owner and Company Applicant:

Not all reporting companies are required to report information about company applicants.

Full Legal Name

Date of Birth

Complete current address

Report the individual’s residential street address, except for company applicants who form or register a company in the course of their business, such as paralegals. For such individuals, report the business street address. The address is not required to be in the United States.

Unique identifying number and issuing jurisdiction from, and image of, one of the following non-expired documents:

U.S. passport

State driver’s license

Identification document issued by a state, local government, or tribe

If an individual does not have any of the previous documents, a foreign passport

Deadline for Filing:

It’s important to note the deadline for this filing to avoid penalties.

Reports will be accepted starting on January 1, 2024.

Reporting companies created or registered to do business before January 1, 2024,

will have additional time — until January 1, 2025 — to file their initial BOI reports.

Reporting companies created or registered on or after January 1, 2024, and before January 1, 2025, have 90 calendar days after receiving actual or public notice that their company’s creation or registration is effective to file their initial BOI reports. Specifically, this 90-calendar day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Reporting companies created or registered on or after January 1, 2025, will have 30 calendar days from actual or public notice that the company’s creation or registration is effective to file their initial BOI reports.

Why Compliance Matters:

Non-compliance with the BOIR can lead to hefty penalties. Beyond legal obligations, this compliance supports efforts to maintain a transparent and trustworthy business environment in the U.S.

What happens if I don’t comply?

The willful failure to report complete or updated beneficial ownership information to FinCEN, or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.

How to File:

Filing the BOIR can be complex. Our team at Stellar Bookkeeping And Taxes is equipped to guide you through this process. We offer comprehensive services to ensure your business meets all FinCEN requirements.

For personalized assistance with your BOIR filing, fill out the contact form from our website. We’re here to help you navigate these regulatory waters with ease.

Conclusion:

Staying compliant with regulations like the BOIR is essential for your business’s integrity and legal standing. With the correct information and support, you can ensure that your business remains on the right side of the law. If you need assistance, please complete the form below for further help.